ESG risk management and its opportunities for companies

The ESG reporting obligation requires companies to address ESG risks. This increases the pressure on risk management within the company. We will show you what you can expect from ESG risk management and demonstrate why good management pays off for you.

Significance of ESG risks for risk management

The obligation to provide ESG reporting places completely new tasks on risk management in companies. Accordingly, risk management must also take ESG risks into accounting in the future. ESG risks are environmental, social and governance-related risks that are expected as part of increasing sustainability measures. These include, for example, rising energy prices and extreme weather events, but also the need for greater safety and equal opportunities in the workplace.

These new developments mean that companies are undergoing increased structural changes and need to reorient themselves strategically.

Overview of ESG risks

Climate risks for companies

Climate risks are, on one hand, the direct effects of climate change on companies and, on the other hand, risks arising from adaptation to climate change.

Rising prices for agricultural commodities

Droughts, floods and storms are causing crop failures and pest infestations around the world. The independent online magazine klimareporter, which regularly reports on the climate and energy transition, shows that the prices of potatoes, chocolate and sugar have risen considerably.

Increase in raw material prices

Due to the shift towards environmentally friendly raw materials and the reduction of greenhouse gas emissions, the price of certain raw materials can be expected to rise in the future.

Rising electricity prices

Why? Too little or too warm water leads to hydroelectric power plants and nuclear power plants across Europe having to reduce or shut down their production.

In addition to the water shortage, hot temperatures are restricting the operation of wind turbines and solar cells. As a result, electricity is becoming scarce and therefore more expensive.

Operational faults

Hailstorms, heatwaves and floods are probably the extreme weather events that first come to mind when we think about the impact of the climate crisis. In fact, a global analysis by AGCS, which looks at corporate claims between 2017 and 2021, shows that natural disasters are the second most common cause of loss and […] “have been the major causes of loss by value of insurance claims” […] (Allianz Global Corporate & Specialty, 2022).

Transitional risks for companies

Companies are increasingly faced with technological challenges such as the switch to lower-emission technologies and the risk of loss of value due to stranded assets. With the transition to new technologies and infrastructures, higher investments and temporary supply bottlenecks are feared. Companies are particularly exposed to risk if the efficiency and profitability of the new technologies are unpredictable and market prices fluctuate. At this point, it is particularly important to keep an eye on the individual risks and opportunities in relation to ESG and to find a suitable strategy.

Social and management-related risks

Loss of Trust

Sustainability is no longer just a trendy topic. Pressure is growing from all sides. And with it comes the risk of losing the trust of your own customers and investors, who are placing more and more value on sustainable and climate-friendly business practices.

Higher risk of changes in interest rates

Companies that do not act in an environmentally friendly way may experience higher interest rates or difficulties in raising money. This is because governments and investors may take measures to penalise non-green businesses.

Risk for lawsuits and fines

Negative effects on the environment and people’s health are increasingly leading to legal problems. New laws that make companies liable for environmental damage or negative effects on health may confront companies with higher costs due to lawsuits and legal consequences in the future.

Reputational risk

Companies that have a harmful impact on their environment risk losing their image. Examples include massive CO2 emissions, noise pollution, water pollution or deforestation. The same applies to companies that attract attention due to a lack of occupational health and safety, exploitation of employees or violence in the workplace, or that enter into harmful business relationships.

Opportunities for good ESG risk management

Efficient ESG risk management helps companies to manage the financial, legal and strategic risks that are expected in the context of sustainability measures. The better the ESG risk management, the greater the chance of establishing oneself on the market and gaining a competitive advantage.

Public recognition

Employees, investors and customers alike are prioritising social responsibility and sustainable thinking more and more.

Transparency is the first step for companies to assess their own sustainability. Disclosing their own goals and strategy with the help of the ESG report provides all parties concerned with information about the quality of their sustainability efforts and offers companies the opportunity to recognise and manage ESG risks and opportunities in real time.

Strengthen staff loyalty

A clear sustainability concept and efficient ESG risk management have an impact on recruitment. Companies that demonstrate the values such as sustainability, diversity, health and environmental protection are anchored in their organisations and attract young, motivated and innovative specialists. And you need them to be able to cope with future changes. The ESG report also shows that you are not greenwashing, but are taking the issue of sustainability seriously and dealing with it in a responsible manner.

Secure capital procurement

ESG reporting is not just a matter for the European Commission, but it is also important for investors and co-operations. Your ESG risk management provides information on the extent to which it is worth investing in your company or entering into a co-operation with your company.

Sustainable growth

Companies make a significant contribution to achieving climate targets. In addition, thanks to efficient ESG risk management, they can secure sustainable growth and new sales if they focus on more energy-efficient and climate-friendly processes and can offer more climate-friendly products and services. The ESG report is probably the first sustainable step towards a sustainability strategy.

Cutting costs midterm

There are several approaches to noticeably reduce the increased costs in companies midterm. These include production with low levels of raw materials, energy and packaging through a circular economy and the further development of products and processes. This way, companies can sustainably counteract the increased material and energy prices and establish themselves on the market.

Another important approach to reducing costs is digitalisation. That’s because automated processes can significantly increase the efficiency of business models and ensure that actual impacts, ESG risks and opportunities are recognised, presented and managed in figures in good time.

Increasing the company value

A good sustainability strategy that fulfils environmental, social and governance (ESG) criteria can help to increase the value and growth of a company. Companies that pursue a convincing ESG strategy have performed better on the stock market in recent years than those that still have deficits in this area. During the last crisis, it became clear that companies with sustainable practices are generally more resilient. In corporate deals, a lack of ESG strategies is now leading to significant discounts in valuations.

Automation helps to reduce ESG risk management costs

Efficient data acquisition

One thing is certain: ESG risk management involves more work. Because you need a lot of data. Starting with analyses of environmental pollution and the use of resources through to key figures on GHG emissions, electricity consumption and evaluations of job satisfaction and gender distribution. This is decentralised data that needs to be processed and linked centrally. Incidentally, our overview of the components of your ESG report shows which key figures you need to report on in detail.

Anyone who has not yet switched to a good software for automated and centralised data collection and analysis should get more information soon. This is because the data must be available for the first companies by the end of 2024.

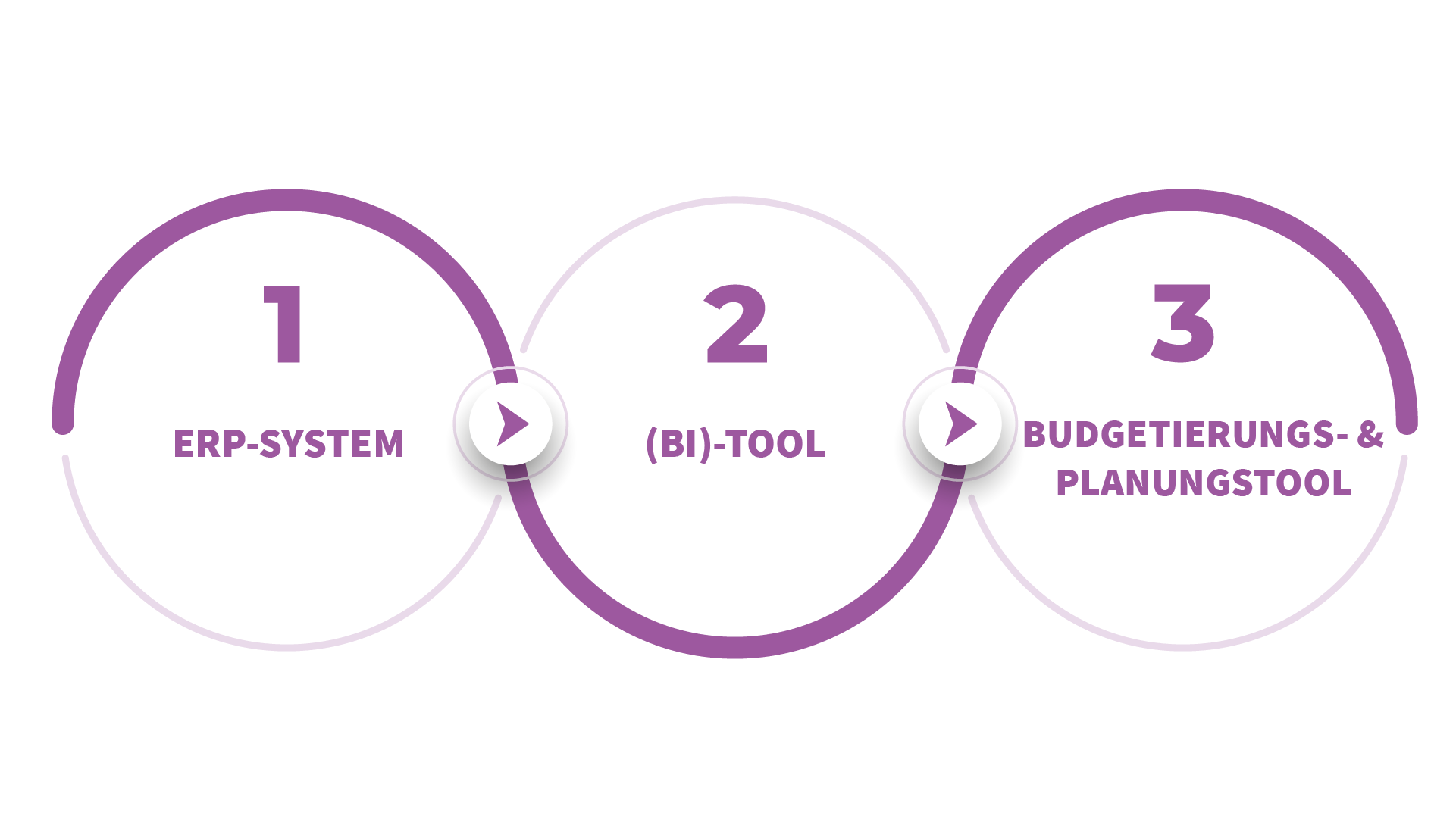

How to achieve holistic risk management

To ensure holistic controlling and ESG risk management, every company should have the following three tools at its disposal:

- ERP System (Enterprise Ressource Planning):

An ERP system is a comprehensive software tool that integrates and automates a company’s various business processes. It enables the efficient recording, management and analysis of data from the areas of finance, production, purchasing, sales and human resources.

- Business Intelligence (BI) Tool:

A BI tool helps companies to analyse and evaluate their data in order to make informed decisions. It offers visualisation and reporting functions, can be connected to different sources and provides ad-hoc queries. By using a BI tool, companies can monitor their performance in real time, recognise trends, identify opportunities and recognise ESG risks early on.

- Budgeting and planning tool:

A budgeting and planning tool supports companies in creating, managing and monitoring their budget and financial forecasts. It enables the definition of planning targets, the allocation of resources, the creation of planning scenarios and the performance of what-if analyses. With such a tool, companies can effectively manage their finances, sales and production figures, but also personnel figures, improve budgeting accuracy and their ESG risk management.

The combination of these three tools - ERP system, BI tool and budgeting and planning tool - offers companies a solid basis for holistic controlling. They enable comprehensive data collection and analysis, informed decision-making and effective management of resources and finances. This enables companies to improve their performance, control costs, capitalise on opportunities and ensure long-term success.

Software solutions such as QVANTUM are suitable as a holistic planning and budgeting tool for your controlling and ESG risk management. They can be connected to BI and ERP systems and even take over department-specific analyses thanks to their ready-to-use dashboards. This gives you a centralised solution as a single source of truth for your ESG data.